Investment strategies have become increasingly essential in today’s financial landscape. With numerous options available, it’s crucial to identify the right avenues to grow your wealth effectively.

One such option gaining popularity is Mutf_in: Hdfc_bala_adv_89vfa1. This mutual fund, offered by HDFC, focuses on balancing risk and returns, making it an appealing choice for both novice and seasoned investors.

In this blog, we will delve into the various aspects of this mutual fund, exploring its features, benefits, and considerations for potential investors.

Key Points

- Balanced Approach: Mutf_in: Hdfc_bala_adv_89vfa1 aims to provide a well-rounded investment solution.

- Diversified Portfolio: The fund diversifies investments across various sectors to mitigate risks.

- Long-Term Growth Potential: This mutual fund focuses on long-term capital appreciation, making it suitable for sustained investment.

What is Mutf_in: Hdfc_bala_adv_89vfa1?

Mutf_in: Hdfc_bala_adv_89vfa1 is a mutual fund scheme that primarily aims to provide investors with a blend of equity and debt investments. This strategy allows for a balance between risk and return, making it suitable for those looking to achieve growth while minimizing exposure to market volatility.

The fund’s structure typically involves allocating a significant portion of its assets in equities to capture growth opportunities, while the remaining is invested in fixed-income securities to provide stability. For example, in a market downturn, the debt portion can help cushion losses, ensuring that your investments do not plummet drastically.

Why Choose Mutf_in: Hdfc_bala_adv_89vfa1?

Choosing Mutf_in: Hdfc_bala_adv_89vfa1 can be beneficial for several reasons:

- Expert Management: Managed by seasoned professionals, the fund benefits from their expertise in navigating market fluctuations.

- Risk Mitigation: The dual strategy of equity and debt helps reduce risk, appealing to conservative investors.

- Accessibility: This mutual fund is designed to be accessible to a wide range of investors, from beginners to those with more experience.

How Does Mutf_in: Hdfc_bala_adv_89vfa1 Operate?

The operational mechanism of Mutf_in: Hdfc_bala_adv_89vfa1 is centered around a hybrid investment strategy. The fund managers actively manage the allocation between equities and fixed-income assets based on market conditions and economic forecasts.

For instance, during a bullish market phase, the fund may tilt more towards equities to capitalize on potential gains. Conversely, in bearish conditions, a shift towards debt securities may be employed to safeguard capital.

Example of Fund Allocation

| Asset Class | Percentage Allocation |

| Equities | 60% |

| Debt | 40% |

This table illustrates how the fund can maintain a balanced portfolio that adjusts according to market dynamics.

What are the Benefits of Investing in Mutf_in: Hdfc_bala_adv_89vfa1?

Investing in Mutf_in: Hdfc_bala_adv_89vfa1 offers numerous benefits:

- Capital Appreciation: The fund aims for long-term growth, making it suitable for wealth accumulation.

- Income Generation: The debt component can provide regular income, adding a layer of financial security.

- Tax Efficiency: Certain investments within mutual funds can be tax-efficient, allowing for better post-tax returns.

Key Benefits Explained

The balanced nature of this fund allows investors to enjoy capital appreciation without exposing them excessively to risk. For example, if the equity markets are performing well, the fund’s equity portion can yield high returns. In contrast, during periods of uncertainty, the debt investments can stabilize returns, ensuring that the investor’s capital remains secure.

Who Should Consider Mutf_in: Hdfc_bala_adv_89vfa1?

Mutf_in: Hdfc_bala_adv_89vfa1 is particularly suitable for investors who:

- Seek Stability: Those looking for a balanced investment approach that mitigates risk.

- Aim for Long-Term Growth: Investors with a long-term horizon who are willing to ride out market volatility.

- Desire Professional Management: Individuals who prefer having experts manage their investments rather than making individual stock picks.

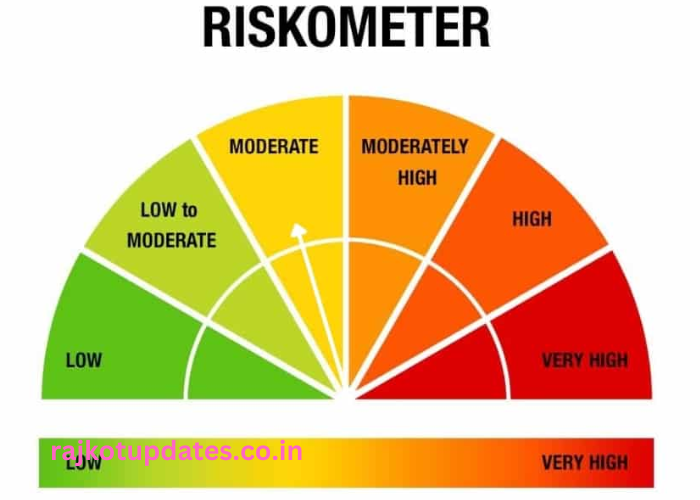

What are the Risks Associated with Mutf_in: Hdfc_bala_adv_89vfa1?

While Mutf_in: Hdfc_bala_adv_89vfa1 offers several advantages, potential investors should also be aware of associated risks:

- Market Risk: Changes in market conditions can affect equity investments adversely.

- Interest Rate Risk: Fluctuations in interest rates can impact the performance of debt securities.

- Managerial Risk: The performance largely depends on the skills of the fund managers.

How to Invest in Mutf_in: Hdfc_bala_adv_89vfa1?

Investing in Mutf_in: Hdfc_bala_adv_89vfa1 can be done through various channels:

- Direct Investment: Investors can approach HDFC directly to purchase units of the fund.

- Financial Advisors: Utilizing a financial advisor can help tailor investment strategies based on individual goals.

- Online Platforms: Numerous online platforms allow for seamless investments in mutual funds.

What is the Minimum Investment Required?

Typically, mutual funds require a minimum investment amount. For Mutf_in: Hdfc_bala_adv_89vfa1, this amount can vary based on the mode of investment. It’s important to check the specific requirements outlined by HDFC or the platform you choose to invest through.

How to Track the Performance of Mutf_in: Hdfc_bala_adv_89vfa1?

Tracking the performance of your investment is crucial. Investors can do this through:

- Fund Fact Sheets: Regularly released documents provide detailed insights into fund performance.

- Online Portals: Many investment platforms offer real-time tracking of mutual fund performance.

- Annual Reports: Reviewing annual reports can give a comprehensive overview of the fund’s performance.

What Are the Fees Associated with Mutf_in: Hdfc_bala_adv_89vfa1?

Understanding the fee structure is essential for potential investors. The costs may include:

- Expense Ratio: This is an annual fee expressed as a percentage of the fund’s average assets under management.

- Exit Load: Some funds impose a charge if investors redeem their units within a certain period.

How Does Mutf_in: Hdfc_bala_adv_89vfa1 Compare to Other Mutual Funds?

When considering Mutf_in: Hdfc_bala_adv_89vfa1, it’s beneficial to compare it with similar mutual funds.

Comparison Table of Mutual Funds

| Fund Name | Equity Exposure | Debt Exposure | Expense Ratio |

| Mutf_in: Hdfc_bala_adv_89vfa1 | 60% | 40% | 1.5% |

| Fund A | 70% | 30% | 1.2% |

| Fund B | 50% | 50% | 1.8% |

This table provides a clear comparison, helping investors decide which fund aligns with their investment goals.

Conclusion

Mutf_in: Hdfc_bala_adv_89vfa1 represents a solid investment option for those seeking a balanced approach to wealth growth. With its diversified portfolio and expert management, it offers a blend of stability and potential high returns.

However, investors must conduct thorough research and consider their financial goals before committing to any mutual fund investment.

FAQs

- What is the primary objective of Mutf_in: Hdfc_bala_adv_89vfa1?

The primary objective is to provide balanced growth through a mix of equity and debt investments. - How often can I redeem my investment in this mutual fund?

Investors can typically redeem their units at any time, subject to the fund’s exit load policies. - What is the expected return from Mutf_in: Hdfc_bala_adv_89vfa1?

Returns can vary based on market conditions; however, the fund aims for long-term capital appreciation. - Can I invest through SIP in Mutf_in: Hdfc_bala_adv_89vfa1?

Yes, Systematic Investment Plans (SIPs) are often available, allowing for regular investments. - Is Mutf_in: Hdfc_bala_adv_89vfa1 suitable for risk-averse investors?

Yes, its balanced approach makes it suitable for investors looking to mitigate risks while seeking growth.