In the world of investment, mutual funds have become a popular choice for individuals seeking to grow their wealth over time. Among the myriad of options available, Mutf_in: Sbi_flex_reg_14a0knf stands out as a flexible investment vehicle offered by SBI Asset Management. This fund caters to investors looking for a blend of growth and risk management, making it an appealing choice for both new and seasoned investors.

The unique feature of Mutf_in: Sbi_flex_reg_14a0knf is its flexibility in investment strategy, which allows for adjustments based on market conditions and individual investor needs. As the financial landscape continues to evolve, understanding the specifics of this mutual fund becomes crucial. In this blog post, we will delve into various aspects of Mutf_in: Sbi_flex_reg_14a0knf, including its key features, investment strategies, performance metrics, and the broader market trends influencing its operations.

What is Mutf_in: Sbi_flex_reg_14a0knf?

Mutf_in: Sbi_flex_reg_14a0knf is a mutual fund scheme managed by SBI Asset Management that provides investors with a flexible investment option. This flexibility allows the fund to adapt its investment approach based on changing market dynamics. The scheme is designed to cater to investors who may have varying risk appetites and investment horizons.

The fund primarily invests in a mix of equities, debt securities, and money market instruments. This diversified approach helps to mitigate risks while aiming for capital appreciation. By providing a flexible investment option Mutf_in: Sbi_flex_reg_14a0knf caters to a wide range of investors, from conservative to aggressive, enabling them to tailor their investment strategy according to their financial goals.

What Are the Key Features of Mutf_in: Sbi_flex_reg_14a0knf?

The features of Mutf_in: Sbi_flex_reg_14a0knf are designed to provide investors with a robust investment experience. One of the standout features is its flexible asset allocation. This means the fund can shift its investments between equity and debt based on market conditions, allowing it to capitalize on growth opportunities while protecting against downturns.

Another significant feature is the professional management provided by SBI Asset Management. The fund is managed by a team of experienced professionals who utilize a combination of fundamental and technical analysis to make informed investment decisions. Their expertise helps to ensure that the fund remains aligned with market trends while maximizing returns for investors.

Additionally, Mutf_in: Sbi_flex_reg_14a0knf offers a systematic investment plan (SIP) option, which allows investors to invest smaller amounts regularly. This approach can be beneficial for those looking to build their investment over time without committing large sums upfront.

How Does Mutf_in: Sbi_flex_reg_14a0knf Compare to Other Mutual Funds?

When evaluating Mutf_in: Sbi_flex_reg_14a0knf, it is essential to compare it with other mutual funds in the market. This comparison can provide insights into its relative performance, expense ratios, and investment strategies.

One of the key advantages of Mutf_in: Sbi_flex_reg_14a0knf is its flexible asset allocation, which distinguishes it from more rigid mutual fund options. Many funds tend to have a fixed equity-debt ratio, while Mutf_in: Sbi_flex_reg_14a0knf can adjust this ratio based on market conditions. This flexibility can potentially lead to better risk-adjusted returns.

Moreover, the performance history of Mutf_in: Sbi_flex_reg_14a0knf should be analyzed in the context of similar funds. Historical performance data can shed light on how the fund has weathered different market conditions compared to its peers. Investors should look at metrics such as annualized returns, consistency, and volatility to assess its relative performance.

Furthermore, the expense ratio is another crucial factor to consider. Lower fees can significantly enhance long-term returns. When comparing Mutf_in: Sbi_flex_reg_14a0knf with other funds, understanding its expense structure is essential for making informed investment decisions.

What Are the Benefits of Investing in Mutf_in: Sbi_flex_reg_14a0knf?

Investing in Mutf_in: Sbi_flex_reg_14a0knf offers several benefits that can contribute to an investor’s portfolio. One of the primary benefits is diversification. By investing across various asset classes, the fund helps reduce the overall risk associated with investing in individual securities.

Additionally, the professional management of the fund provides investors with peace of mind. With a dedicated team monitoring market trends and making strategic decisions, investors can rely on their expertise to optimize performance Mutf_in: Sbi_flex_reg_14a0knf also allows for greater flexibility compared to traditional mutual funds. Investors can adjust their investment strategy based on their risk tolerance and market conditions, making it a versatile choice for a wide range of investors.

Another advantage is the accessibility of the fund. With options like SIP, investors can start with smaller amounts and gradually increase their investment, making it suitable for both beginners and seasoned investors.

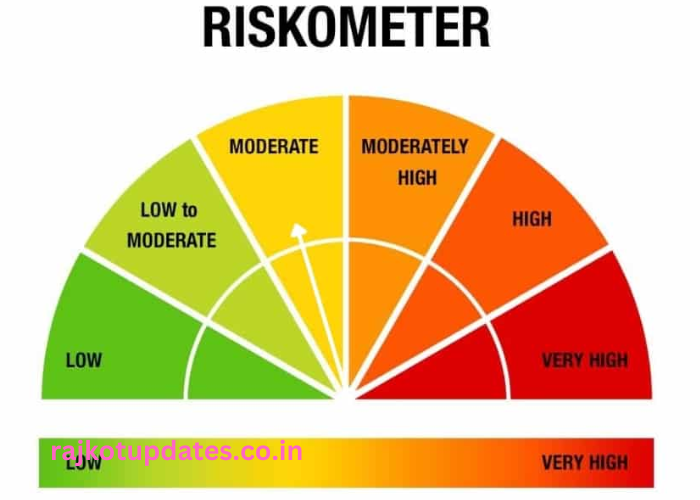

What Are the Risks Associated with Mutf_in: Sbi_flex_reg_14a0knf?

While there are numerous benefits to investing in Mutf_in: Sbi_flex_reg_14a0knf, it is important to be aware of the associated risks. Market risk is a primary concern, as the value of the fund’s investments can fluctuate based on market conditions. This volatility can impact the fund’s performance, particularly in challenging market environments.

Additionally, management risk is another factor to consider. Even with experienced managers, the investment decisions made may not always yield the expected results. It’s crucial for investors to understand that past performance does not guarantee future results.

Furthermore, liquidity risk is relevant when investing in certain securities within the fund. While mutual funds typically offer liquidity, some underlying assets may have lower trading volumes, which can affect the fund’s ability to sell positions without impacting their prices significantly.

How to Invest in Mutf_in: Sbi_flex_reg_14a0knf?

Investing in Mutf_in: Sbi_flex_reg_14a0knf is a straightforward process that can be initiated by conducting thorough research on the fund. Prospective investors should familiarize themselves with its investment objectives, historical performance, and associated risks.

Once they have gathered the necessary information, individuals can invest through multiple channels. This could be via the SBI Asset Management website, through a financial advisor, or using online investment platforms that provide access to mutual funds.

It’s essential for investors to determine their investment amount and choose the appropriate plan that aligns with their financial goals. Whether opting for a systematic investment plan (SIP) or a lump-sum investment, making informed decisions is key to maximizing returns.

What Are the Current Trends Influencing Mutf_in: Sbi_flex_reg_14a0knf?

The investment landscape is influenced by various trends that can affect funds like Mutf_in: Sbi_flex_reg_14a0knf. One significant trend is the increasing emphasis on sustainable and responsible investing. Investors are increasingly prioritizing funds that incorporate environmental, social, and governance (ESG) factors into their investment strategies.

Additionally, advancements in technology have transformed the investment landscape. The rise of robo-advisors and mobile investment apps has made it easier for retail investors to access mutual funds like Mutf_in: Sbi_flex_reg_14a0knf, expanding the potential investor base and democratizing investment opportunities.

The current economic climate, characterized by fluctuating interest rates and inflation concerns, also plays a crucial role in shaping investment strategies. Investors must stay informed about these trends to make well-timed decisions regarding Mutf_in: Sbi_flex_reg_14a0knf and similar funds.

Conclusion

In conclusion, Mutf_in: Sbi_flex_reg_14a0knf offers a flexible and diversified investment opportunity for those looking to participate in the mutual fund market. By understanding its features, benefits, risks, and the current trends affecting it, investors can make informed decisions that align with their financial objectives.

The expertise of SBI Asset Management further enhances the appeal of this fund, providing investors with the confidence to invest. As the financial environment continues to evolve, staying updated on developments related to Mutf_in: Sbi_flex_reg_14a0knf will empower investors to navigate the complexities of the investment world effectively. Whether you are a seasoned investor or just beginning your investment journey, exploring the potential of this mutual fund could play a pivotal role in achieving your financial goals.